Using debit and (or) credit cards is among the most popular and expedient means of purchasing Bitcoins. On a majority of exchanges, by using a debit or credit card, your bitcoins will be delivered to you instantly. However, this expediency may come at a price, given that most crypto exchanges charge a fee of approximately 4% for purchases made using debit or credit cards. This fee, however, does not apply when you use a bank transfer to buy bitcoins on the exchange.

As we proceed, we will be comparing and contrasting various digital currency exchanges that will enable you to purchase bitcoins using a debit or credit card.

Coinbase

As one of the most sought-after and reputable cryptocurrency exchanges globally, Coinbase has been pushing to bring digital currencies to the general public since its launch in 2012. To purchase bitcoins on Coinbase, simply create an account, link a payment method of your preference, and you are good to go.

Deservingly, Coinbase was most recently valued at USD 8 billion. It has an amazingly easy-to-use interface that enables anyone regardless of their background to effortlessly purchase cryptocurrencies such as bitcoin.

Coinbase works in collaboration with the United States’ financial authorities. As such, you can be certain that any profits earned as a result of Bitcoin’s appreciation or purchases above USD 20,000 will be deemed taxable.

Coinbase users are required to submit a picture of their ID to verify their account’s identity.

Note: Whereas credit card purchases on the Coinbase exchange are not enabled for US-based users, you can still make your payments using a debit card as a citizen of the United States.

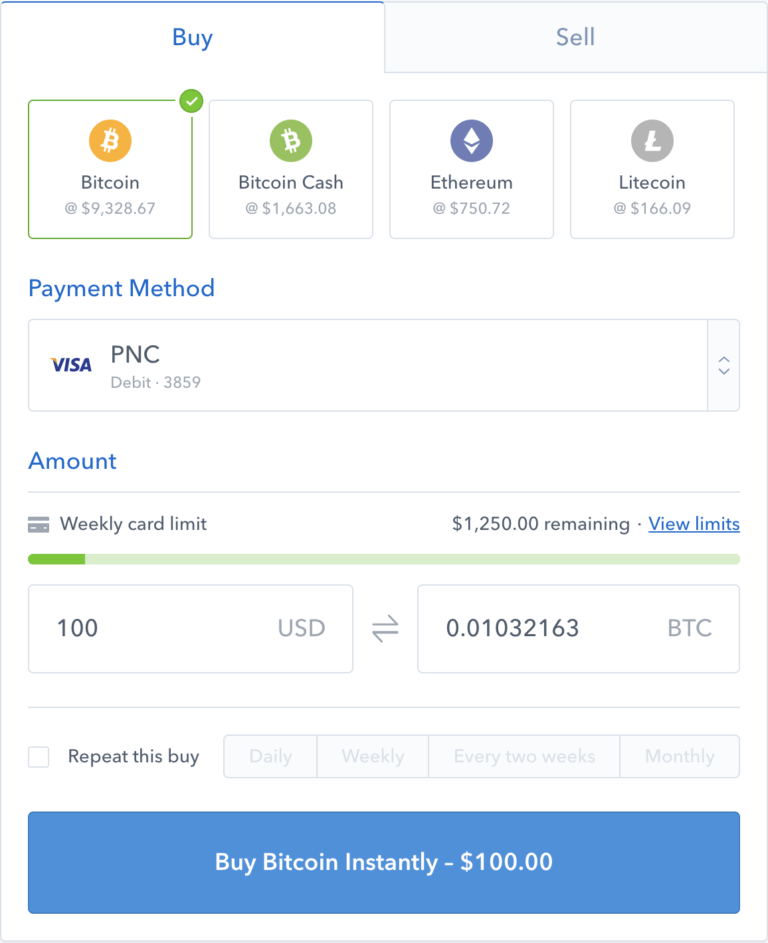

Coinbase fees and limits

Coinbase charges phenomenally low fees for purchases made using credit and (or) debit cards as compared to the competition at 3.99%. The exchange’s purchasing limits are passably low as compared to its peers’. Contingent upon the level of your account’s verification, you will be in a position to purchase varying amounts of digital currencies daily. The topmost tier of accreditation on Coinbase allows for daily purchases of up to $50,000.

Depositing cryptocurrencies onto the Coinbase exchange is free. Transaction fees are only applicable upon purchase.

On the whole, Coinbase provides a magnificent starting point for newbies, considering it has an extremely easy-to-use interface, as well as a speedy registration process.

Coinmama

Coinmama is similarly a great option. It offers various packages that have particular cryptocurrency amounts. In case you want a specific amount that is not offered in their packages, you will have to give a specification of the number of bitcoins you intend to purchase.

Another unique feature of the Coinmama exchange is that they don’t offer their users a wallet for hoarding the cryptocurrencies they have purchased on the exchange. Rather, you will be prompted to provide a wallet to which the purchased cryptocurrencies will be transferred.

Coinmama is highly reputable in the cryptocurrency community considering their customer support is very reliable and they have been operational for quite some time. They are established in Israel and support nearly all US states as well as many other countries.

Coinmama’s Fees and Limits

With an estimated 5% fee on purchases made using credit and debit cards, Coinmama’s fees are significantly higher than coinbase’s. However, with Coinmama, you are guaranteed instant delivery of your coins. Furthermore, they offer higher purchasing limits at a maximum of USD 5,000 daily and USD 20,000 on a monthly basis. Their minimum purchase is 60 dollars.

Bitpanda

Bitpanda stands out from other crypto exchanges by offering a variety of payment methods and digital currencies. They only sell cryptocurrencies to clients based in Europe and their rates and fees are acutely competitive.

They have a pretty clean user interface, enabling newbies to easily purchase cryptocurrencies on the platform. Other than credit cards, the exchange also offers Skrill, Giropay, OBT, Sofort transfers, EPS, and SEPA transfers.

On the Bitpanda platform, you will be prompted to provide an ID upon registration. It is for this reason that most users, particularly those who are keen about their privacy, will not find it an apt option.

Silver tier authentication, with a similar purchasing limit as bronze, is yet to be released. Nonetheless, the selling limits are almost twofold. The exchange’s other transaction and withdrawal fees are all quite plausible in comparison to other exchanges.

Bitpanda’s Fees and Limits

In entirety, Bitpanda’s service fees range between 3 – 4 percent. This range is contingent upon the circumstance and is not directly displayed at checkout. Bitpanda users are able to purchase different cryptocurrency amounts depending on their level of verification.

Whereas bronze is the lowest verification level, allowing users to purchase up to €50 worth of bitcoins daily, gold is the highest level allowing users to purchase up to €10,000 worth of bitcoins using a credit or debit card.

All in all, Bitpanda is a terrific option for Europe-based users.

CEX.io

Based in London, United Kingdoms, CEX.io has been serving the crypto community since 2013. The exchange guarantees top-notch security, exceptional liquidity, and multi-platform trading via their site, mobile application, and API solutions. As per their website, CEX.io has more than two million active traders. They also offer margin trading services for interested users, and almost 100% uptime.

They have a decent service coverage, supporting 24 states in the US, and 99 percent of countries globally.

CEX.io’s Fees and Limits

Regarding fees and limits, CEX.io is highly competitive with a 3.9 percent deposit fee on credit and debit card purchases. They charge a 2.9% fee whenever you sell Bitcoins back to your card. This is a unique feature to CEX.io given that most exchanges will not let you sell back onto your credit card.

Though not really the case, CEX.io seemingly offers free purchasing services. A premium is charged upon purchase. This elementally implies that the cryptocurrencies are sold at prices above the normal rate.

Bitstamp

Bitstamp’s popularity is attributed to its first-mover advantage as the first fully accredited bitcoin exchange globally. Other than providing credit & debit card purchases, Bitstamp also allows users to make purchases via bank transfers, SEPA transfers, and many more. As a matter of fact, users are even able to cash out their balances in gold.

This, nonetheless, does not avert the ability to purchase crypto assets via debit and credit cards. The exchange has a user-friendly interface that is adaptable to navigation and oversight. As is the case with other services, purchases via a debit card on this exchange call for ID verification.

Bitstamp’s Fees and Limits

Bitstamp’s credit purchases follow a staggered fee system as outlined below:

- 8% fee for purchases of up to $500/€500

- 7% fee for purchases of up to $1,000/€1,000

- 6% fee for purchases of up to $2,500/€2,500

- 5% fee for purchases of up to $5,000/€5,000

On the whole, Bitstamp fees are significantly low as compared to other exchanges, given that other services accrue a fee of 5% and above for card processing alone.

LocalBitcoins

LocalBitcoins’ services are slightly different from those of other exchanges. They have varying prices since users specify the amount they wish to exchange for bitcoins. The fact that each vendor on the platform has a review history enables you to have an idea of the transaction’s trustworthiness.

In addition, the platform records the average time a vendor takes to respond to the buyer’s order.

On the whole, LocalBitcoins is an amazing p2p option for purchasing bitcoins using credit and (or) debit cards.

LocalBitcoin’s Fees and Limits

LocalBitcoins’ services accrue a 1 percent fee and contingent upon a seller’s offered price, buyers could technically pay more.

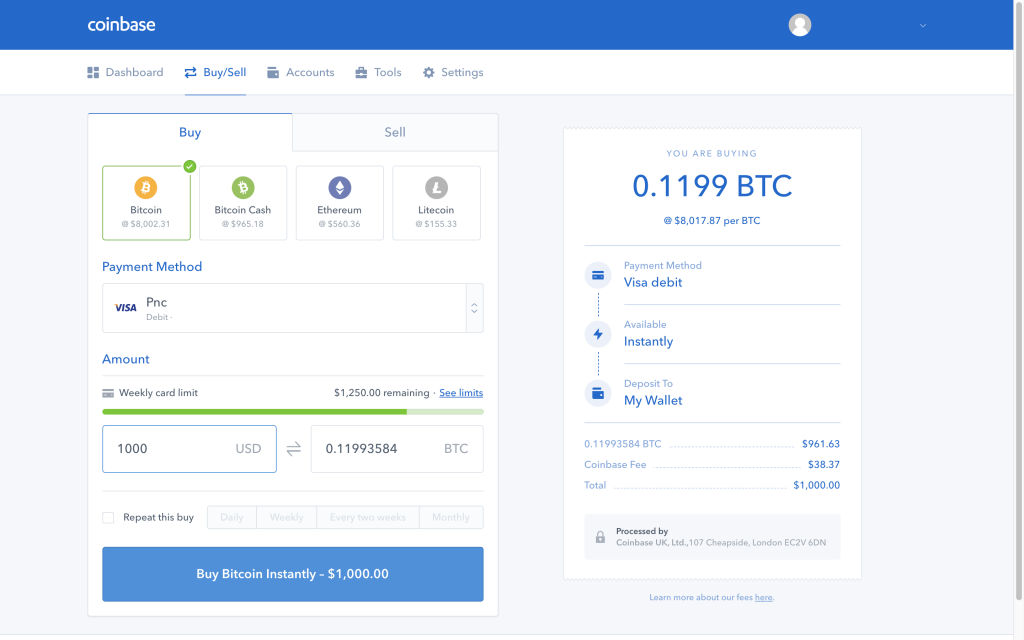

Buying Bitcoin on Coinbase

Below is a step-by-step guide to buying bitcoins on Coinbase:

- Create an account:

To purchase Bitcoin on the Coinbase exchange, you will be required to first sign up for a Coinbase account. To do this, simply click the “Create Account” button and then verify your email address.

- Verify your cell phone number:

Key in your phone number. To verify the number is yours, Coinbase will send you a verification code via SMS. Enter the code on the provided text field to proceed to the next step.

- Identity verification:

In this step, you will be required to confirm your ID by filling in a number of fields.

From here, you are only a few steps away from getting ready to start purchasing bitcoins.

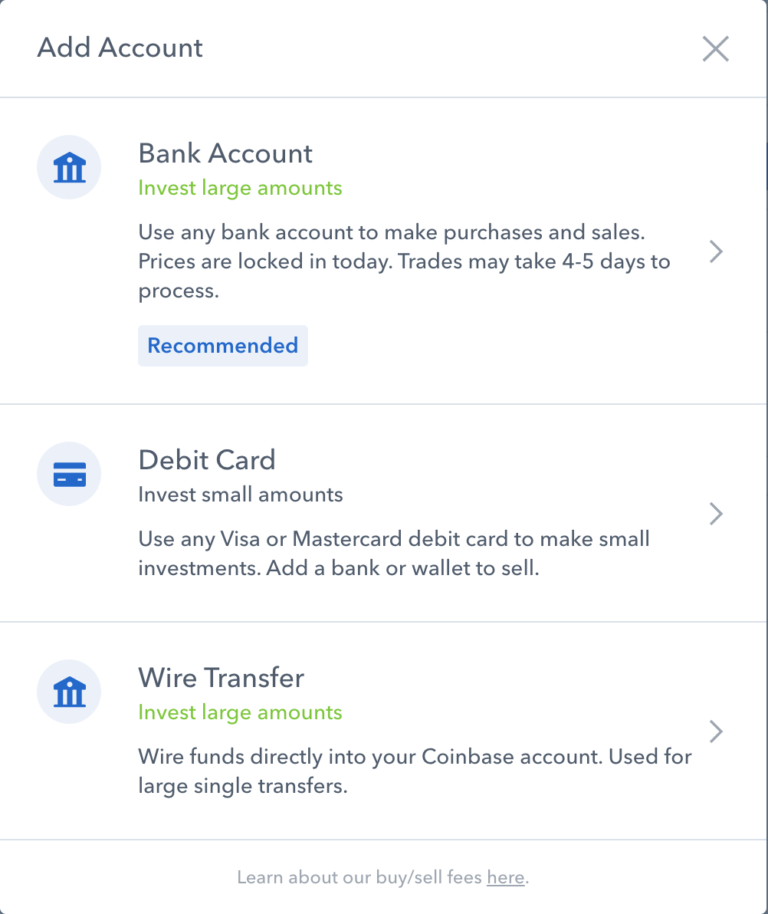

- Link a new account:

On the navigation menu bar, click on the settings tab and then click the “Link a new account” button. After that, select the payment method you wish to link.

This is the final step after which you are ready to make your Bitcoin purchase payment.

- Buy Bitcoin:

To proceed, click the buy/sell tab on the nav bar. Enter the amount in dollars or BTC and then click Buy!

Hooray! Congratulations on your first Bitcoin purchase. Given that you used a debit card to make the purchase, your Bitcoin will be instantly deposited to your bank account.

Buying Bitcoin on Coinmama

To purchase Bitcoin using a card on Coinmama, follow the step-by-step guide below:

- Create an account:

To purchase Bitcoin on the Coinmama exchange, you will be required to first sign up for a Coinmama account. To begin, you will be required to provide some basic information.

- Identity verification:

In this step, you will be required to confirm your ID by filling in a number of fields.

While this may sound annoying, it is compulsory for Coinmama to better serve its clients. However, this is only done once. Click the “NEXT” button after you are done. You may further be prompted to upload a photo as proof of your identity. Otherwise, you are good to go. You are now ready to make your Bitcoin purchase on the Coinmama exchange platform.

- Buy Bitcoin:

To proceed, click the Bitcoin tab on the nav bar to begin the buying process. You will be redirected to the exchange’s packages page, where you could either select a stipulated amount or enter your preferred amount. After specifying your amount, click the “Buy Now” button. You will be redirected to the next page where you will fill in your wallet address. To make certain the pricing is precise, the order expires.

- Key in your card details:

Enter the details of your card and then click “Pay Now”. After a short while, you will receive your Bitcoin.

Congratulations! You have successfully purchased Bitcoin on the Coinmama exchange.

FAQs

- What is the best way to buy Bitcoin instantly using a debit or credit card?

Coinbase is the aptest exchange platform to use for purchasing Bitcoin and other cryptocurrencies instantly using a card.

- What is the advantage of buying Bitcoin with a card?

Debit and (or) credit cards are a much faster way of purchasing cryptocurrencies such as Bitcoin. If instead you opt to use your bank account, it would take the exchanges between 3 to 8 business days for the exchange to deliver your cryptocurrencies.

- What are some of the drawbacks of using credit cards to purchase Bitcoin?

One major drawback of using a card to purchase Bitcoin is that it accrues higher fees. For instance, while the fee for purchasing Bitcoin on Coinbase using your bank is 1.49%, you will be charged a 3.99% fee for purchasing Bitcoin on the Coinbase exchange using a credit or debit card.

The other major drawback is that card purchases have daily and monthly limits. On the Coinmama exchange, for instance, you can only purchase a maximum of $5,000 in a day.

- Is it better to trade Bitcoin, or should I just hold onto my coins?

This is for you to decide and is contingent upon how experienced you are in cryptocurrency trading, as well as how willing you are to take the risk.

Conclusions

Presently, Bitcoin’s card purchases’ market rate is lingering around 5 percent. As much as this is seemingly high for a basic cryptocurrency transaction, it is easily justifiable considering the security hazards faced by crypto exchanges, as well as the plausible gains cryptocurrencies have to offer.

Leave a Reply